How to plan the best trading approach?

Trading in Forex is a systematic process. Whether you are trading currencies or commodities, you need a systematic approach to placing an order. Otherwise, your trading business will not be successful. Instead of making profits from it, you will lose capital. And sometimes, the losses might be frequent. Instead of trading dynamically, you must approach with an efficient process. It must contain the best risk management for the investment.

Besides, you will need a valid profit target for the trade. Both the investment and profit target will help with position sizing. As a result, you can secure the best trade setups. After everything is ready, the only thing left to do is market analysis. A trader who has expert analytical skills can find profits consistently. On the other hand, rookie traders will struggle to manage even decent profit sometimes.

If a trader struggles to find valuable position sizes, risk management helps to secure his investment. On the contrary, a proper position size finds suitable stop-loss and take-profit for the trades. So, we can see, any trader can secure the trading business. However, he will need the best tools and techniques to do that. And, preparing a systematic trading approach helps a lot in this case.

Taking proper trading experiences

A trader would be inefficient if he does not have any experience of it. He will forget about risk management and market analysis. Then, his investment policy will take a hit. Without sorting out the lots and leverage ratio, he will make a purchase. As a result, anyone will mistake placing the orders. Contrarily, poor risk management increases potential loss. Plus, it increases tension among the traders. So, they cannot analyze the markets for the best position sizing. If a trader wants to secure his career, position sizing is crucial. Without it, no execution is safe from losses. Due to a lack of analytical skills, traders cannot find a suitable spot for stop-loss or take-profit.

So, to understand everything in this business, every trader should get some experience. Some might hesitate to open a live account with real money. In that case, a demo account can be helpful. It does not require any genuine investment. However, a rookie trader must commit to learning efficient trading. Additionally, he must know which currencies are traded most in Forex. By learning about the most traded pairs, the overall learning process will become much easier.

Using practical risk management

When you have experienced the trading business from a demo account, you will consider proper money management. Every trader experience frequent loss when they are a novice. They lose money due to inefficient trading skills. Even with valuable ideas, traders fail to keep track of everything sometimes. In those cases, they cannot but fail to handle the execution process efficiently. As a result, they lose money from the account. However, a rookie trader can change this phenomenon while participating in his trading business.

When you invest time in risk management, it helps to reduce potential losses. Furthermore, it improves your trading mentality by diminishing tensions. Then, any work becomes easy for a trader. Above all, a trader who cares about risk management takes care of his business with valuable trading fundamentals. So, stop being unprofessional and implement worthy risk management plans in your business.

Focusing on the position sizes

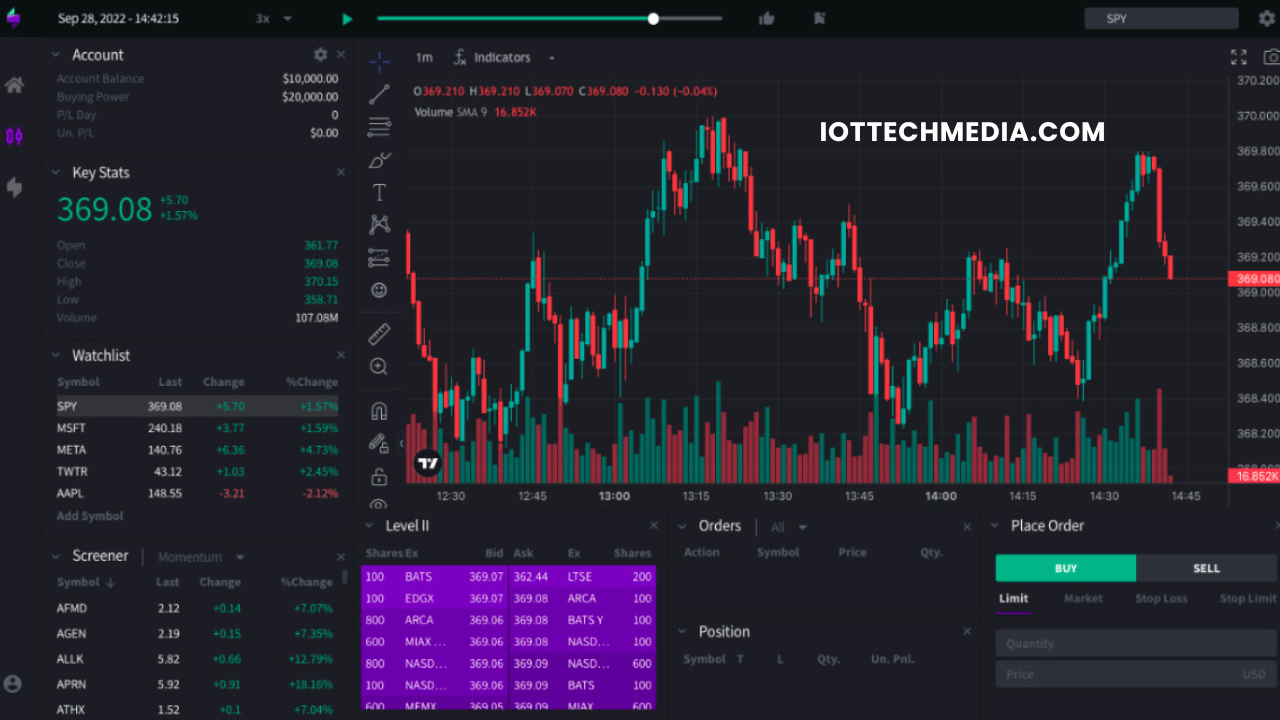

Position size is securing your purchase in the markets. If you can implement it carefully, your trades will have a less potential loss. Plus, with position sizing, a trader can easily avoid any poor trade signal. As a result, it increases the potential of your trading business. The expert traders use position sizing to secure their investment. By using the stop-loss, they predefine the exit point according to the presumed risk.

They also use the take-profit to secure the profit potentials of a healthy signal. An experienced trader who knows about Forex never underestimates the value of position sizing. Since it is a part of systematic trade execution, you should not neglect it either.